Services

Insurance Gateway

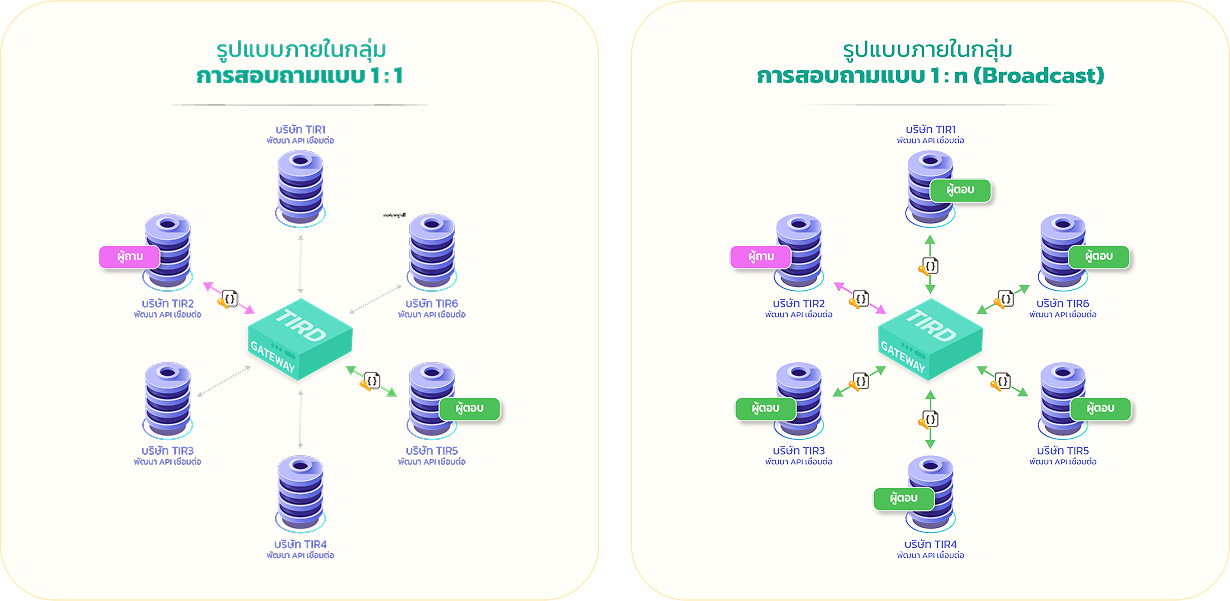

Insurance Data Exchange Gateway

Build a network for seamless transaction data exchange within the insurance industry. Boost operational efficiency for insurers by streamlining the verification and validation process, ensuring accurate claims handling,especially in cases of fraud or identity theft.

State-of-the-Art Data Security

HTTPS Protocol

Our Insurance Gateway ensures robust, encrypted data transmission by utilizing the HTTPS Protocol. This guarantees that all transactions are securely transmitted, protecting sensitive business information from potential cyber threats.

Public IP

TIRD Insurance Gateway is restricted to specific, pre-registered Public IP addresses, safeguarding against unauthorized access attempts.

Asymmetric Key Encryption

All data, including questions and answers sent through our Insurance Gateway are encrypted using Asymmetric Key encryption with Public and Private Keys from a trusted Certification Authority (CA).

Zero data retention

Data exchanged online (Server to Server) via TIRD Insurance Gateway are not stored or retained in the system, ensuring the highest level of data security.

TIRD Insurance Gateway facilitates a wide range of data exchanges

Inquire about compensation for Knock for Knock claims.

Inquire about compensation for other claim details.

Inquire about coverage for automobile insurance.

Knock For Knock

Get in touch with the TIRD team and find the right solutions for your sustained success!

Software Development

Expert software design and development for a seamless experience.

TIRD provides comprehensive software development services, delivering tailored solutions for your business needs. Our team of expert developers specializes in creating intuitive, secure, and scalable applications designed to meet your unique requirements.

Our Services

We have experience in developing various types of software, including web applications, mobile apps, internal management systems, and custom solutions tailored to the specific needs of our clients. We work closely with our clients to achieve the best results.

Why choose TIRD Software Development Services?

Expertise and Experience

Our development team brings a wealth of expertise and experience in the insurance industry, delivering tailored, secure software solutions that enhance efficiency and ensure compliance.

Cutting-Edge Technology

We utilize the latest technologies in development, such as React, Node.js, and more, to ensure that the solutions we create can efficiently support future growth.

Development within Budget and Timeline

We are committed to delivering projects on time and within budget, without compromising on quality.

Security and Reliability

The security of your data is our top priority. We use world-class security standards in the development of all our applications.

Post-Sales Support

After your solution is developed and deployed, we offer ongoing support and maintenance services to ensure that your system operates smoothly.

Our Software Development covers a wide range of services

Web Application

Mobile Application

การออกแบบ UX/UI

System Maintenance

พัฒนา API และการบูรณาการระบบ

Satisfaction guaranteed.

We are committed to providing the best solutions for your business by paying attention to every detail and fully listening to your needs. Contact us for a free consultation and start developing solutions that can enhance the efficiency of your business.

Get in touch with the TIRD team and find the right solutions for your sustained success!

Get in touch with the TIRD team and find the right solutions for your sustained success!

Data Warehouse Development

Transform your data into actionable insights.

If your business requires seamless management of large datasets and integration of information from various sources across the organization, TIRD expert team specializes in building Data Warehouses that are perfectly aligned with your needs, ensuring optimal performance and scalability.

Why choose TIRD Data Warehouse Development

Efficient, Scalable Data Warehouse with BI Support

We design flexible data warehouses that process large volumes of data quickly and accurately, scale with your business growth, and seamlessly integrate with BI tools like Power BI and Tableau to optimize data analysis and business decision-making.

Industry Expertise:

With deep experience in the insurance sector, our development team crafts secure, customized data warehouses that drive efficiency and ensure regulatory compliance.

Data Security and Dependability:

We prioritize the security of your data by employing world-class security measures throughout the development process to ensure your data warehouse remains safe and reliable.

Ongoing Support:

After deployment, we offer continuous support and maintenance to ensure your data warehouse functions smoothly and meets evolving business needs.

Our Data Warehouse Development covers an array of services and solutions

Customized Data Warehouse

Data Migration and Integration

ETL (Extract Transform Load)

Data Lake & Big Data Solution

Cloud Data Warehouse Maintenance (AWS, Google Cloud, Azure)

Business Intelligence (BI) Integration

Data Management and Analytics Consultation

Why choose TIRD

Expertise and Experience

Our development team has extensive experience and expertise in developing Data Warehouses for the insurance industry.

Customization for Business Needs

We understand the unique requirements of the insurance business, allowing us to tailor Data Warehouses to meet the specific needs of the insurance industry.

High Performance

We are dedicated to building systems with high performance in data processing, capable of supporting your organization’s growth.

Post-Sales Support

We provide ongoing support and maintenance services to ensure your Data Warehouse operates seamlessly without interruptions.

Get in touch with the TIRD team and find the right solutions for your sustained success!

CMI Online

Software as a Service (SaaS) for Car Insurance and Compulsory Insurance Sales

TIRD provides an efficient, ready-to-use software solution designed to empower insurance agents and brokers in processing sales transactions, along with real-time reporting to the Office of Insurance Commission (OIC).

Achieve more with our CMI Services

Easily set up master and sub-agent accounts for insurance brokers and agents.

Manage sales amounts together with brokers' and agents' sales activities with Credit control functionality.

Save time by duplicating policy history for policy renewals in the following year.

Ensure data security as brokers and agents can only search and access policy history of the policies they own.

Sold policies are instantly reported to the Office of Insurance Commission (OIC) in real-time.